- #Best budget apps that link to bank account driver#

- #Best budget apps that link to bank account full#

- #Best budget apps that link to bank account download#

- #Best budget apps that link to bank account free#

#Best budget apps that link to bank account free#

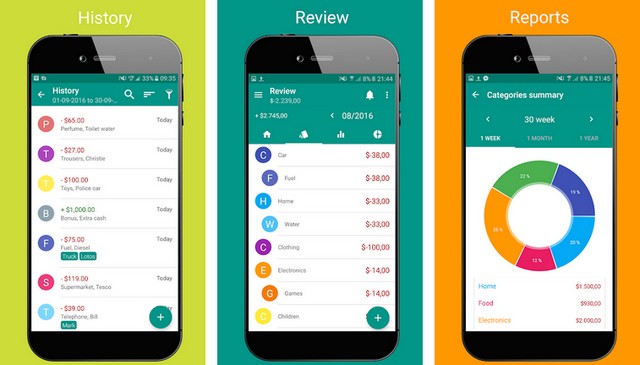

Canstar also has a budgeting app created by Frollo.Ĭanstar has a free budgeting app, powered by Frollo, that you might like to check out. Frollo can also send you money tips and notifications – for instance, letting you know if you have upcoming bills. You can create multiple money goals within the app and track your progress. Frollo then categorises all of your transactions and keeps track of your regular payments and when they are due. You can sync all of your financial accounts (such as your transaction, savings, credit card, loans, super and investments) with Frollo and see them in one place.

#Best budget apps that link to bank account download#

Additionally, like Beem, to use the app with a group of people, everyone needs to download the app individually.įrollo is a free Australian budgeting app. Splitwise is free to download, but there are in-app purchases if you want to access the app’s ‘pro features’, which include no ads, currency conversion and the ability to save default splits. Splitwise is a bill-splitting app that automatically splits payments between members of a group and tallies up who-owes-who what. Splitwise is another app that could help you manage shared bills and expenses. WeMoney says it uses bank-level encryption, but as with any budgeting app, it’s important to weigh up whether you are comfortable sharing your personal information.

#Best budget apps that link to bank account driver#

Additionally, to create an account you will need to provide some photo ID (such as a driver licence or passport).

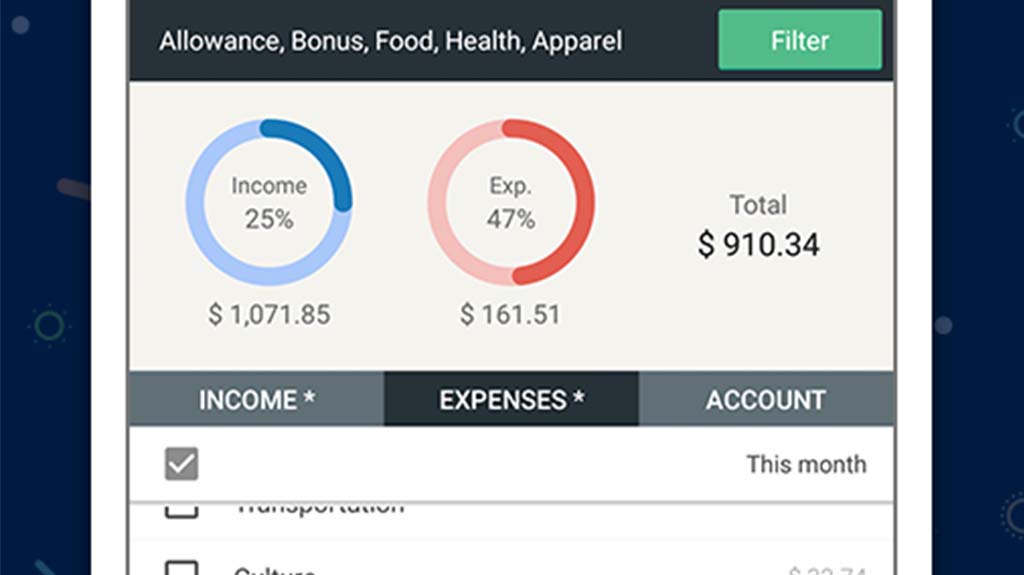

But, it’s important to note WeMoney only displays offers from its partners and may not cover all your options. Other features include the ability to check your credit score and an offers section. Through the app you can automatically categorise your transactions, track your bills and subscriptions and set monthly budgets and money goals.

This can give you a clearer picture of your net worth. Through the free app, you can connect accounts, including supported savings, loans, credit cards, super, buy now pay later, investment and cryptocurrency accounts. WeMoney is designed to give you a ‘360-degree view’ of your finances. Buddy is also only currently available on the App Store. It currently costs $4.99 per month or $34.99 per year.

#Best budget apps that link to bank account full#

You can also sync your transactions with a partner or loved one and create shared budgets.īuddy is free to download, but you have to pay a subscription to unlock full functionality of the app. Instead, you can add transactions to the app. Unlike some other budgeting apps, you do not have to sync your bank account to the app. Google Play rating: 4.3, 8.71K reviews.īuddy is a Swedish budgeting app that allows you to create budgets and track your expenses.For Standard portfolios, it is currently $3.50 per month for accounts under $15,000, or 0.275% per year for accounts $15,000 and over. Raiz is free to download, but there are fees when you start investing. You can also see where you spend your money based on categories like ‘shopping’ and ‘food and dining’. Raiz also offers a My Finance feature, which gives you a personalised overview of your spending and forecasts your future cash flow using your linked accounts. Raiz is best known for its ‘round-up’ feature, which rounds up your transactions to the nearest dollar and invests the change.

0 kommentar(er)

0 kommentar(er)